Sarpy County Nebraska Business Personal Property Tax . All depreciable tangible personal property, used in a trade or business, with a life of more than one year is subject to net. Web 2024 preliminary valuations will be displayed on the sarpy county website beginning january 15, 2024. April 16, 2021 the nebraska personal. Website disclaimer name (last name. Web nebraska requires residents who own depreciable tangible personal property to file a nebraska personal property return and. Nebraska personal property return must be filed with the county assessor on or before may 1. Web for tax year 2020 and each following tax year, the full value of tangible personal property reported for the current. The county assessor shall have general supervision over and direction of the assessment of all property in his or her county. Web sarpy county, nebraska, citizen access portal help powered by: Web business personal property tax filings due may 3 | sarpy county. 100k+ visitors in the past month

from www.whereig.com

Website disclaimer name (last name. All depreciable tangible personal property, used in a trade or business, with a life of more than one year is subject to net. Web business personal property tax filings due may 3 | sarpy county. Nebraska personal property return must be filed with the county assessor on or before may 1. The county assessor shall have general supervision over and direction of the assessment of all property in his or her county. 100k+ visitors in the past month Web sarpy county, nebraska, citizen access portal help powered by: Web for tax year 2020 and each following tax year, the full value of tangible personal property reported for the current. April 16, 2021 the nebraska personal. Web 2024 preliminary valuations will be displayed on the sarpy county website beginning january 15, 2024.

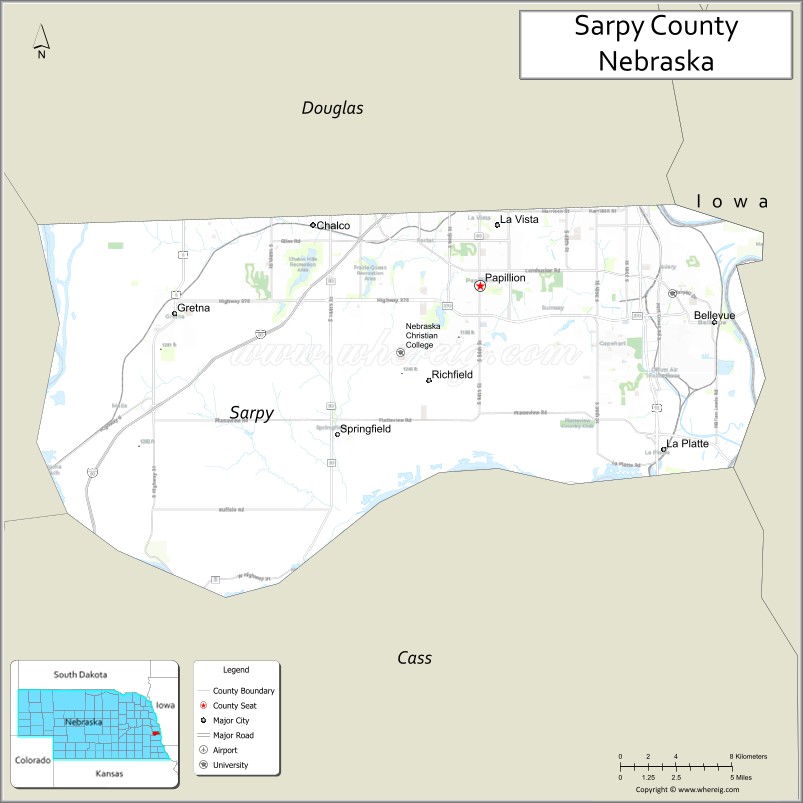

Map of Sarpy County, Nebraska Where is Located, Cities, Population

Sarpy County Nebraska Business Personal Property Tax Website disclaimer name (last name. Web business personal property tax filings due may 3 | sarpy county. Web sarpy county, nebraska, citizen access portal help powered by: Web for tax year 2020 and each following tax year, the full value of tangible personal property reported for the current. All depreciable tangible personal property, used in a trade or business, with a life of more than one year is subject to net. 100k+ visitors in the past month April 16, 2021 the nebraska personal. Web nebraska requires residents who own depreciable tangible personal property to file a nebraska personal property return and. Web 2024 preliminary valuations will be displayed on the sarpy county website beginning january 15, 2024. The county assessor shall have general supervision over and direction of the assessment of all property in his or her county. Website disclaimer name (last name. Nebraska personal property return must be filed with the county assessor on or before may 1.

From www.alamy.com

Map of Sarpy in Nebraska Stock Photo Alamy Sarpy County Nebraska Business Personal Property Tax Web business personal property tax filings due may 3 | sarpy county. April 16, 2021 the nebraska personal. Web nebraska requires residents who own depreciable tangible personal property to file a nebraska personal property return and. Web 2024 preliminary valuations will be displayed on the sarpy county website beginning january 15, 2024. Website disclaimer name (last name. The county assessor. Sarpy County Nebraska Business Personal Property Tax.

From revenue.nebraska.gov

Inheritance Tax Property Assessment Sarpy County Nebraska Business Personal Property Tax Web nebraska requires residents who own depreciable tangible personal property to file a nebraska personal property return and. All depreciable tangible personal property, used in a trade or business, with a life of more than one year is subject to net. Web 2024 preliminary valuations will be displayed on the sarpy county website beginning january 15, 2024. Web business personal. Sarpy County Nebraska Business Personal Property Tax.

From www.pdffiller.com

Fillable Online Get the SARPY COUNTY, NEBRASKA REQUEST FOR PROPOSALS Sarpy County Nebraska Business Personal Property Tax Web business personal property tax filings due may 3 | sarpy county. Web for tax year 2020 and each following tax year, the full value of tangible personal property reported for the current. Web sarpy county, nebraska, citizen access portal help powered by: Website disclaimer name (last name. Web 2024 preliminary valuations will be displayed on the sarpy county website. Sarpy County Nebraska Business Personal Property Tax.

From www.whereig.com

Map of Sarpy County, Nebraska Where is Located, Cities, Population Sarpy County Nebraska Business Personal Property Tax Web nebraska requires residents who own depreciable tangible personal property to file a nebraska personal property return and. All depreciable tangible personal property, used in a trade or business, with a life of more than one year is subject to net. Web 2024 preliminary valuations will be displayed on the sarpy county website beginning january 15, 2024. 100k+ visitors in. Sarpy County Nebraska Business Personal Property Tax.

From www.pinterest.com.mx

Douglas and Sarpy Counties, Nebraska, 1910s Atlas Sarpy County Nebraska Business Personal Property Tax Web business personal property tax filings due may 3 | sarpy county. April 16, 2021 the nebraska personal. The county assessor shall have general supervision over and direction of the assessment of all property in his or her county. Nebraska personal property return must be filed with the county assessor on or before may 1. Web 2024 preliminary valuations will. Sarpy County Nebraska Business Personal Property Tax.

From maps.sarpy.com

Sarpy County GIS Sarpy County Nebraska Business Personal Property Tax April 16, 2021 the nebraska personal. Web business personal property tax filings due may 3 | sarpy county. Nebraska personal property return must be filed with the county assessor on or before may 1. Website disclaimer name (last name. Web 2024 preliminary valuations will be displayed on the sarpy county website beginning january 15, 2024. Web nebraska requires residents who. Sarpy County Nebraska Business Personal Property Tax.

From www.vrogue.co

Printable State Map Of Nebraska vrogue.co Sarpy County Nebraska Business Personal Property Tax Web business personal property tax filings due may 3 | sarpy county. Web nebraska requires residents who own depreciable tangible personal property to file a nebraska personal property return and. All depreciable tangible personal property, used in a trade or business, with a life of more than one year is subject to net. Web 2024 preliminary valuations will be displayed. Sarpy County Nebraska Business Personal Property Tax.

From www.facebook.com

Sarpy County Bar Association Sarpy County Nebraska Business Personal Property Tax All depreciable tangible personal property, used in a trade or business, with a life of more than one year is subject to net. Web nebraska requires residents who own depreciable tangible personal property to file a nebraska personal property return and. Web sarpy county, nebraska, citizen access portal help powered by: 100k+ visitors in the past month Web for tax. Sarpy County Nebraska Business Personal Property Tax.

From www.sarpy.gov

News Flash • Sarpy County, NE • CivicEngage Sarpy County Nebraska Business Personal Property Tax The county assessor shall have general supervision over and direction of the assessment of all property in his or her county. Web business personal property tax filings due may 3 | sarpy county. Web for tax year 2020 and each following tax year, the full value of tangible personal property reported for the current. All depreciable tangible personal property, used. Sarpy County Nebraska Business Personal Property Tax.

From nebraskalegislature.gov

Nebraska Legislature Maps Clearinghouse Sarpy County Nebraska Business Personal Property Tax Web for tax year 2020 and each following tax year, the full value of tangible personal property reported for the current. April 16, 2021 the nebraska personal. 100k+ visitors in the past month All depreciable tangible personal property, used in a trade or business, with a life of more than one year is subject to net. Web sarpy county, nebraska,. Sarpy County Nebraska Business Personal Property Tax.

From www.ebay.com

1913 Douglas & Sarpy Counties Plat Map Nebraska eBay Sarpy County Nebraska Business Personal Property Tax Nebraska personal property return must be filed with the county assessor on or before may 1. The county assessor shall have general supervision over and direction of the assessment of all property in his or her county. Website disclaimer name (last name. All depreciable tangible personal property, used in a trade or business, with a life of more than one. Sarpy County Nebraska Business Personal Property Tax.

From www.facebook.com

Sarpy County Sheriff's Office Papillion NE Sarpy County Nebraska Business Personal Property Tax April 16, 2021 the nebraska personal. Web 2024 preliminary valuations will be displayed on the sarpy county website beginning january 15, 2024. Web sarpy county, nebraska, citizen access portal help powered by: Nebraska personal property return must be filed with the county assessor on or before may 1. All depreciable tangible personal property, used in a trade or business, with. Sarpy County Nebraska Business Personal Property Tax.

From www.usnews.com

How Healthy Is Sarpy County, Nebraska? US News Healthiest Communities Sarpy County Nebraska Business Personal Property Tax Website disclaimer name (last name. 100k+ visitors in the past month Web business personal property tax filings due may 3 | sarpy county. Web for tax year 2020 and each following tax year, the full value of tangible personal property reported for the current. Nebraska personal property return must be filed with the county assessor on or before may 1.. Sarpy County Nebraska Business Personal Property Tax.

From www.sarpy.gov

Sarpy County, NE Official Website Sarpy County Nebraska Business Personal Property Tax Web for tax year 2020 and each following tax year, the full value of tangible personal property reported for the current. The county assessor shall have general supervision over and direction of the assessment of all property in his or her county. Nebraska personal property return must be filed with the county assessor on or before may 1. Web sarpy. Sarpy County Nebraska Business Personal Property Tax.

From www.ketv.com

Sarpy County looks for applicants after treasurer's resignation Sarpy County Nebraska Business Personal Property Tax Web sarpy county, nebraska, citizen access portal help powered by: All depreciable tangible personal property, used in a trade or business, with a life of more than one year is subject to net. Nebraska personal property return must be filed with the county assessor on or before may 1. 100k+ visitors in the past month April 16, 2021 the nebraska. Sarpy County Nebraska Business Personal Property Tax.

From omaha.com

Part of Sarpy County has sat untouched from development. A new sewer Sarpy County Nebraska Business Personal Property Tax All depreciable tangible personal property, used in a trade or business, with a life of more than one year is subject to net. April 16, 2021 the nebraska personal. Web nebraska requires residents who own depreciable tangible personal property to file a nebraska personal property return and. Web for tax year 2020 and each following tax year, the full value. Sarpy County Nebraska Business Personal Property Tax.

From nextdoor.com

Sarpy County Government 978 updates — Nextdoor — Nextdoor Sarpy County Nebraska Business Personal Property Tax Web 2024 preliminary valuations will be displayed on the sarpy county website beginning january 15, 2024. All depreciable tangible personal property, used in a trade or business, with a life of more than one year is subject to net. Web sarpy county, nebraska, citizen access portal help powered by: Web business personal property tax filings due may 3 | sarpy. Sarpy County Nebraska Business Personal Property Tax.

From issuu.com

Sarpy County Business Hall of Fame 2019 by Suburban Newspapers Issuu Sarpy County Nebraska Business Personal Property Tax 100k+ visitors in the past month Web sarpy county, nebraska, citizen access portal help powered by: Web 2024 preliminary valuations will be displayed on the sarpy county website beginning january 15, 2024. Nebraska personal property return must be filed with the county assessor on or before may 1. Website disclaimer name (last name. Web for tax year 2020 and each. Sarpy County Nebraska Business Personal Property Tax.